mississippi income tax rate

Detailed Mississippi state income tax rates and brackets are available on. Compare your take home after tax and estimate.

Mississippi Income Tax Reform Details Evaluation Tax Foundation

For an in-depth comparison try using our federal and state income tax calculator.

. Welcome to The Mississippi Department of Revenue. This tool compares the tax brackets for single individuals in each state. Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets.

Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. For income taxes in all fifty states see the income tax by state. Currently the corporate income tax rates are 3 percent for the first 5000 4 percent for the next 5000 and 5 percent on anything beyond.

2022 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Mississippi Tax Brackets for Tax Year 2021. As you can see your income in Mississippi is taxed at different rates within the given tax brackets.

Seniors will also like the fact that most retirement income is exempt from Mississippi tax. The Mississippi income tax accounts for 34 of state revenue. How do I compute the income tax due.

The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. Mailing Address Information. Mississippi also has a 400 to 500 percent corporate income tax rate.

Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent. These rates are the same for individuals and businesses. For more information about the income tax in these states visit the Mississippi and Tennessee income tax pages.

Mississippis income tax rate is 5. Its a flat rate which. The Mississippi corporate tax rate is changing.

Box 23058 Jackson MS 39225-3058. Mississippi has a graduated tax rate. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

3 on the next 2000 of. If you are receiving a refund PO. Outlook for the 2023.

Lawmakers said the tax cut would reduce state revenue by 185 million in the first year. Eligible Charitable Organizations Information. JACKSON Miss AP Mississippi Gov.

At what rate does Mississippi tax my income. The graduated income tax rate is. These local taxes bring the total sales and use tax rates that can be charged by local taxing jurisdictions to as much as 1025.

Mississippi income tax rate and tax brackets shown in the table below are based on income earned between January 1 2022 through December 31 2022. Combined Filers - Filing and Payment Procedures. If you move after filing your Mississippi income tax return you will need to notify the Department of Revenue of your new address by letter to.

Any income over 10000 would be taxes at the. Hurricane Katrina Information. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate.

Plus the tax rate on taxable income above 10000 is gradually reduced starting in 2024. Box 23050 Jackson MS 39225-3050. Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent.

Tate Reeves promised to push for a full elimination of the states income tax during the 2023 legislative session. All other income tax returns P. There is no tax schedule for Mississippi income taxes.

By the final year the figure would be 525. The personal income tax which has a top rate of 5 is slightly lower than the national average for state income taxes. Mississippi has a graduated income tax rate and is computed as follows.

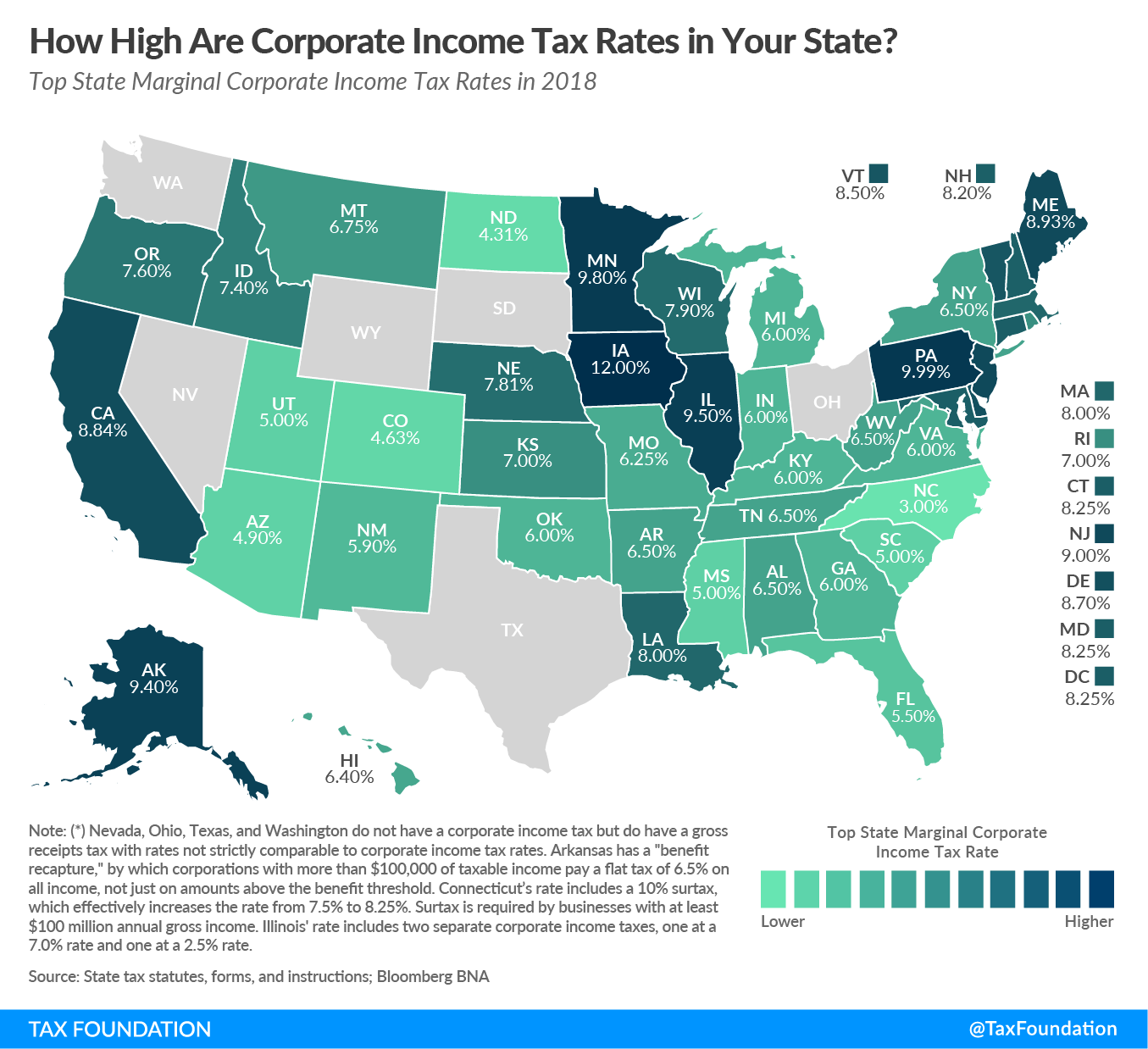

However the statewide sales tax of 7 is slightly. Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200. 0 on the first 3000 of taxable income.

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

How To Form An Llc In Mississippi Llc Filing Ms Swyft Filings

How To File And Pay Sales Tax In Mississippi Taxvalet

Mississippi Retirement Tax Friendliness Smartasset

Payroll Software Solution For Mississippi Small Business

Every State With A Progressive Tax Also Taxes Retirement Income

Mississippi Tax Forms And Instructions For 2021 Form 80 105

If Doctors Chose Their Job Locations Based On State Income Taxes White Coat Investor

Mississippi Governor Signs State S Largest Income Tax Cut

Why Alabama S Taxes Are Unfair Al Com

Mississippi Sales Tax Calculator And Local Rates 2021 Wise

3 Things Inflation Fact Checking State Tax Rates Sagebroadview

How To Form An Llc In Mississippi Llc Filing Ms Swyft Filings

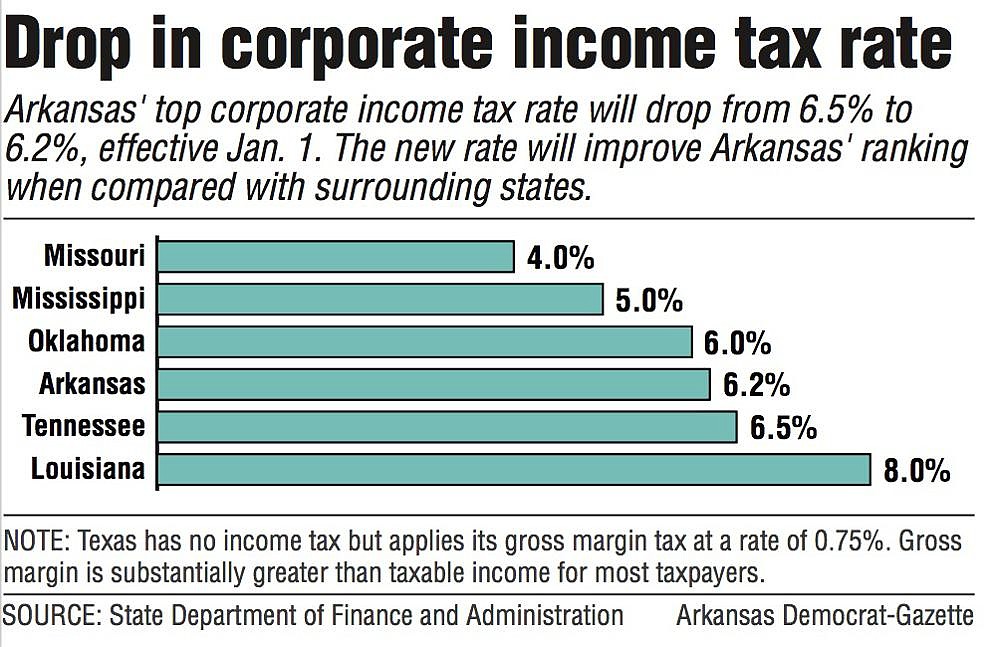

Top Corporate Income Tax Rate Declines